E-commerce is evolving in a challenging global environment. After years of explosive cross-border e-commerce growth, sellers now face increasing pressure from regulatory changes, rising the costs, and new tariff policies. In this moment of uncertainty, customs compliance has become a critical part of protecting margins and ensuring reliable delivery. If you’re not careful, small missteps can lead to costly delays, returns, penalties, or worse—seized goods and damaged brand reputation. In this post, we’ll cover five common customs compliance mistakes that e-commerce sellers make, and show you how to avoid them with smarter processes and tools.

⚠️ Mistake #1: Using generic or incorrect HS codes

Harmonized System (HS) codes are critical to how customs authorities classify products. Many sellers reuse old codes or guess based on similar products. This can lead to misclassification, resulting in overpaying duties or having shipments held at the border. Every product needs accurate classification based on its specific features, materials, and intended use.

Pro tip: Automate HS code classification with AI-driven tools to ensure consistency and accuracy at scale.

⚠️ Mistake #2: Ignoring country-specific duty and tariff rules

Customs regulations are not one-size-fits-all. Countries have different duty thresholds (known as de minimis), tax rates, and restrictions on imports. And in today’s volatile trade climate, tariffs are increasingly used as political tools. For example, ongoing tariff adjustments between the U.S. and China, or newly proposed EU digital taxes, can have a direct impact on your landed costs and margins.

Pro tip: Use a duty calculator or an integrated compliance tool that automatically applies country-specific rules and accounts for current tariff changes in real time.

⚠️ Mistake #3: Failing to screen for IP violations

Selling goods that infringe on trademarks or copyrights—even unintentionally—can lead to takedown notices or customs seizures. Marketplaces like Amazon and eBay have become strict about enforcing intellectual property rules.

Pro tip: Use image recognition and text screening tools to catch trademarked elements before listing or shipping products.

⚠️ Mistake #4: Relying on manual data entry

Still managing customs data in spreadsheets or copy-pasting descriptions from product pages? Manual workflows are error-prone and can cause major mismatches between declared content and what’s actually shipped.

Pro tip: Automate product data validation and sync your inventory with your compliance system to eliminate human errors.

⚠️ Mistake #5: No pre-shipment compliance checks

Some sellers skip compliance checks altogether and hope for the best. This gamble can result in packages returned to sender, surprise charges for customers, or even regulatory fines. Compliance must start before the product leaves the warehouse.

Pro tip: Implement pre-shipment screening that verifies product data, duties, taxes, and restrictions in real time, while factoring in current tariff scenarios.

How SafePackage™ helps

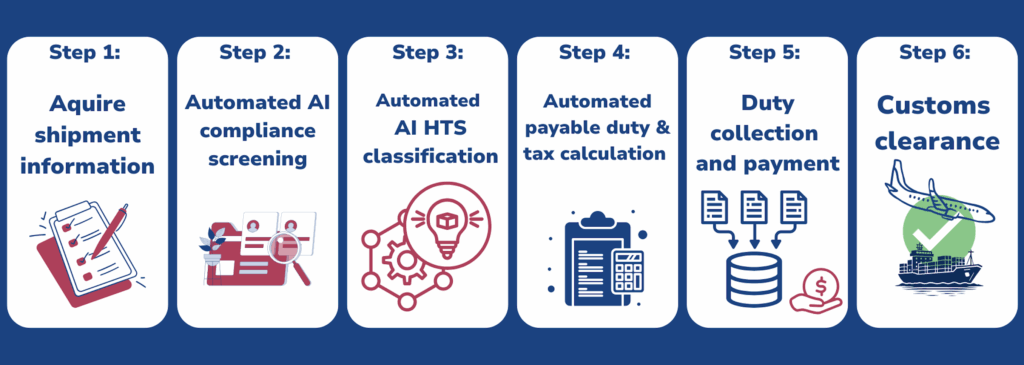

SafePackage™ is designed for e-commerce sellers who want to take the guesswork out of global shipping. Our AI-powered platform scans your products, validates your HS codes, and calculates accurate duties and taxes for each destination country. It also checks for potential IP violations using computer vision and natural language processing. Importantly, SafePackage™ stays up to date with tariff shifts and regulatory changes so you can adapt your pricing and shipping strategies without delays.

SafePackage™ is designed for e-commerce sellers who want to take the guesswork out of global shipping. Our AI-powered platform scans your products, validates your HS codes, and calculates accurate duties and taxes for each destination country. It also checks for potential IP violations using computer vision and natural language processing. Importantly, SafePackage™ stays up to date with tariff shifts and regulatory changes so you can adapt your pricing and shipping strategies without delays.

Benefits:

✅ Reduce delays and returns

🚫 Avoid IP-related penalties

📊 Navigate tariff changes with confidence

🎯 Increase customer satisfaction

🤝 Build trust with customs authorities

Ready to simplify your customs workflow? Contact us today!

Customs compliance doesn’t have to be complex. By avoiding these five common mistakes and using automation where it matters most, you can reduce costs, speed up delivery, and protect your business from unnecessary risk. Make compliance part of your growth strategy—not a roadblock to it.